Solana (SOL) is showing signs of a strong comeback, with analysts eyeing a potential rally toward the $200 mark.

Despite recent market turbulence, SOL’s resilience at key support levels, coupled with its expanding DeFi ecosystem and growing institutional interest, suggests a bullish outlook. Investors are now watching closely to see if this momentum can drive a sustained breakout.

Solana’s Price Action and Key Support Levels

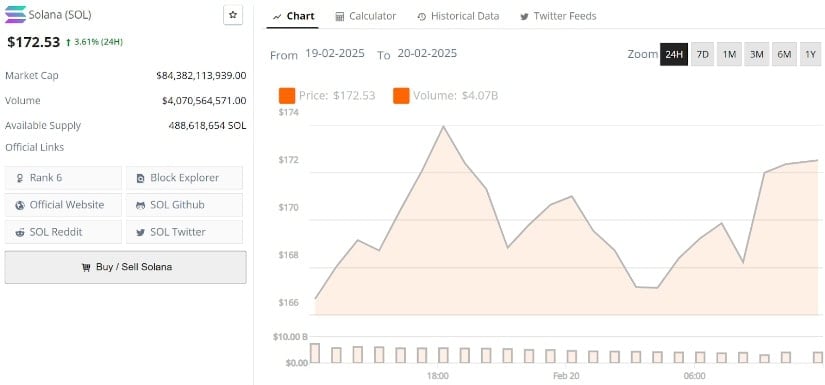

After falling sharply, Solana’s price stabilized around the $170 support level, a critical region that had also acted as a reversal point in the past, mid-January. This pullback is characteristic of a potential double-bottom structure, a bearish reversal that is often succeeded by strong price bounces.

Bears likely wanted a quick drop to force selling, but if Solana holds $170, it could rally to above $200. Source: Crypto Pellets on Binance Square

“If SOL continues above $170 and builds momentum, we can expect a strong move towards $200,” a market analyst said. “But affirmation from indicators like the RSI and MACD is still needed.”

Solana is now facing resistance at $181.99, with further challenges at $196.11 and $204.42. Breaching these might pave the way for a stronger uptrend. On the downside, breaching $170 might accelerate losses, which might test the $160 region where $138 million of leveraged positions are aggregated.

Institutional Support and DeFi Growth

Despite the recent turbulence, underlying growth in Solana is strong. Coinbase has recently listed Solana futures on its crypto derivatives product, which will provide institutional investors with new channels to gain exposure to SOL. It is part of a broader trend of increased institutional adoption of digital assets.

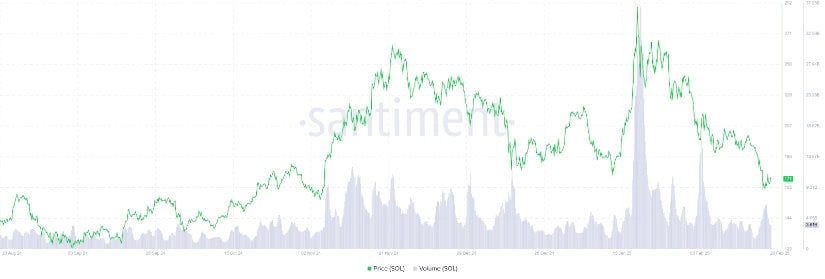

Solana’s trading volume has been on a rising trend since the beginning of 2025. Source: Santiment

Meanwhile, Solana’s DeFi component continues to expand. The network witnessed an explosion in stablecoin inflows with over $3.2 billion of USDT and USDC inundating its ecosystem during 2025—a 37.3% rise within a period of 50 days. Jito and Jupiter protocols have seen staggering TVL growth, further establishing Solana as one of the leading DeFi platforms.

Challenges: Meme Coin Scandals and Token Unlocks

Apart from its strong fundamentals, Solana has been marred by concerns over meme coin scams and inflationary pressures. The ecosystem has been home to several high-profile rug pulls, including the Official Trump ($TRUMP) and Melania Meme Coin ($MELANIA) incidents, which saw tokens skyrocket before crashing as insiders exited positions. These scams have eroded trust and led to a sharp decline in Solana-based meme coin market capitalization, dropping from $25 billion in January to $10 billion.

Solana (SOL) was trading at around $172.53, up 3.61% in the last 24 hours at press time. Source: Brave New Coin

Adding to the pressure, Solana faces an upcoming $1.8 billion token unlock linked to the FTX bankruptcy proceedings. The network also maintains its 40,000 SOL tokens per day release, which is worth around $6 million in sell pressure on a daily basis. These may add to the volatility in the short term.

Market Outlook: Can Solana Break the Negative Cycle?

Despite recent lows, however, there are still analysts who are optimistic about Solana’s long-term prospects. Asset manager VanEck has forecast that SOL will reach $520 by the end of the year based on its growing market share in the smart contract space. In the short term, Changelly has forecasted a possible price increase to $206.63.

Solana price is expected to recover from the $170-$180 support zone and surpass $200. Source: Luna via X

Watch – Solana Price Prediction Video

For now, Solana’s direction relies on its capacity to hold important support levels and restore investors’ confidence. If the price sustains above $170 and volumes rise during trading, SOL might be set for a vigorous rebound. Nevertheless, any inability to hold this level could attract more downward pressure, and the next couple of days will be vital in determining the cryptocurrency’s direction.

With strong institutional backing, a thriving DeFi ecosystem, and bullish technical patterns, Solana’s journey to $200 remains within reach—but overcoming short-term challenges will be essential for sustained growth.