Bitcoin’s mining difficulty has recorded a steep -11.16% adjustment, marking the largest downward move since the July 2021 crash triggered by China’s mining ban.

- Bitcoin mining difficulty dropped 11.16%, the biggest decline since 2021 and one of the largest in history.

- Storm outages and a market sell-off temporarily reduced hashrate, but network power has already rebounded sharply.

- Miner profitability hit record lows, accelerating the shift toward AI infrastructure and alternative revenue streams.

The drop ranks as the 10th biggest negative adjustment in the network’s history and signals how quickly external shocks can ripple through the system.

The February 7, 2026 adjustment followed a sudden decline in network hashrate. Severe winter storms across parts of the United States forced multiple mining facilities offline, while a broader market sell-off pushed Bitcoin’s price into the low $60,000 range. Together, these pressures reduced overall computational power securing the network, prompting the automatic difficulty recalibration.

Hashrate Rebounds Despite Profitability Squeeze

Despite the sharp correction, network data shows that hashrate has already rebounded by roughly 20% over the past two weeks. As storm-affected miners restore operations, computing power is steadily returning to the network.

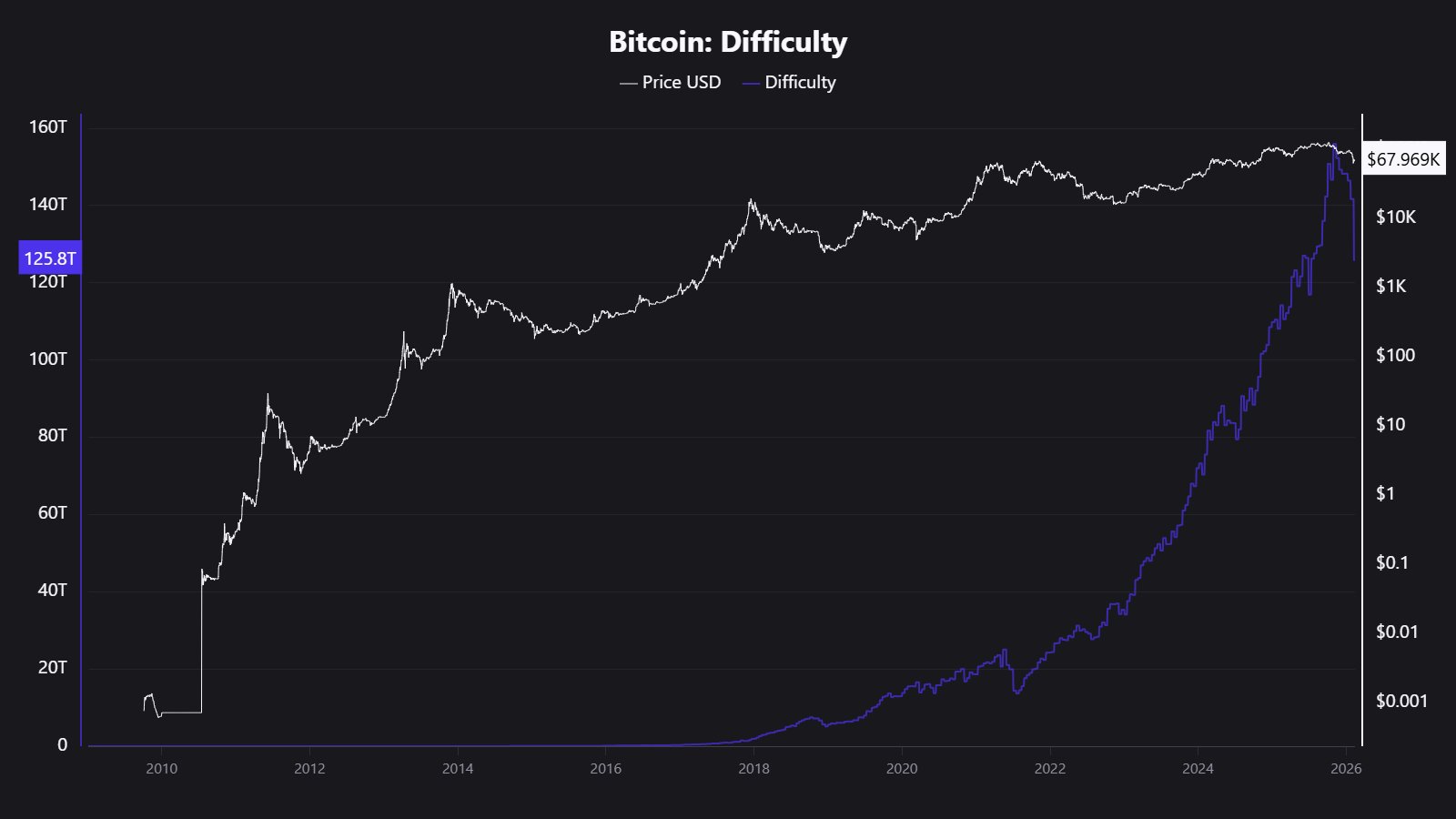

However, profitability remains under pressure. Hashprice – a key metric measuring miner revenue per terahash – plunged to a record low near $0.03 per TH/s on February 5. For comparison, that figure stood near $3.50 in 2017, highlighting how competitive and capital-intensive the mining industry has become.

With hashrate climbing again, the next difficulty adjustment, expected around February 20, is projected to swing in the opposite direction, with estimates pointing to a positive correction of roughly 11.5%.

Mining Firms Pivot Toward AI Infrastructure

Volatile revenues are accelerating strategic shifts among large mining operators. Companies such as CleanSpark and TeraWulf are increasingly converting or expanding data center infrastructure to support Artificial Intelligence workloads. The strategy aims to create diversified revenue streams that are less exposed to Bitcoin price cycles.

Corporate restructuring and capital raises are also shaping the sector. Cango Inc. recently secured $75.5 million in equity funding to expand its integrated energy and AI compute platform, while Argo Blockchain received court approval for a restructuring plan addressing $40 million in unsecured notes.

Local Restrictions and Global Clarity

Regulatory developments continue to influence the mining landscape. Canton, North Carolina, passed a 12-month moratorium on new cryptocurrency mining and data center developments on February 11, reflecting growing scrutiny at the municipal level.

In contrast, the Abu Dhabi Global Market issued updated guidance formalizing the licensing and supervision of crypto mining as a recognized commercial activity. The move provides greater regulatory clarity for operators seeking to establish operations in the region.

The latest difficulty adjustment underscores how sensitive Bitcoin’s mining ecosystem remains to weather events, market volatility, and regulatory shifts. Yet the swift hashrate rebound also highlights the network’s resilience, with miners adapting rapidly to changing conditions while exploring new revenue models beyond traditional block rewards.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.