Litecoin (LTC) is showing strong signs of a potential breakout, positioning itself for a rally toward $150 or higher.

The recent technical setup and positive market sentiment have drawn attention from both retail and institutional investors. As of October 28, 2025, LTC trades around $105, rebounding from a period of consolidation between $91 and $115 over the past month. Traders are closely monitoring the chart, anticipating a continuation of the bullish momentum as LTC approaches critical resistance levels.

The current price action reflects renewed optimism in the Litecoin market. Analysts point to a symmetrical triangle pattern on the 4-hour chart, which historically signals a breakout once the price breaches the upper trendline. Combined with growing institutional interest and broader market support, this pattern underscores the potential for a significant upward move in LTC price.

Technical Analysis: Symmetrical Triangle Signals Breakout

A detailed examination of the 4-hour LTC/USDT chart shows Litecoin bouncing off ascending support within a symmetrical triangle pattern. This formation indicates that the coin has been consolidating in preparation for a potential breakout. Traders note that if LTC can break above the upper boundary of the triangle, it may trigger a strong rally toward the $150 level or higher.

LTC has bounced off ascending support and is poised to break out of a symmetrical triangle, targeting $150 and above. Source: @ramseycrypto via X

Candlestick patterns and Heikin Ashi charts also suggest increasing bullish pressure, reflecting higher lows and improving market sentiment. Analysts advise that traders use this opportunity to monitor entries near support levels while implementing risk management strategies, such as stop losses, to navigate the inherent volatility of crypto markets. The pattern provides a clear visual framework for potential price targets in the short term.

Market Dynamics: ETF Launch Fuels Optimism

The launch of Canary Capital’s first U.S.-listed spot Litecoin ETF on October 28, 2025, has added another layer of bullish sentiment. Market observers note that ETF approval often leads to greater institutional inflows, enhancing liquidity and market depth. Following the ETF announcement, LTC experienced a 3.5% price rise, reflecting investor confidence in Litecoin’s potential for growth.

Litecoin (LTC) shows bullish momentum as LTCD appears to have bottomed, signaling a potential 165% upside. Source: @VuoriTrading via X

This development signals increased mainstream adoption for Litecoin, encouraging both long-term investors and active traders. Many analysts believe that the combination of technical momentum and ETF-driven market participation could accelerate LTC’s climb, particularly as the cryptocurrency gains attention from traditional finance circles. The ETF launch may also set a precedent for other digital assets seeking similar exposure.

Analyst Forecasts and Broader Outlook

Analyst predictions for Litecoin in 2025 vary but generally remain optimistic. Some forecasts suggest that LTC could reach $200 by the end of the year, while more conservative estimates place the target around $130-$150. The cryptocurrency’s history as a fast and reliable Bitcoin fork, coupled with ongoing technical advances, supports the potential for strong upward movements.

A long trade on LTC is set with an entry at $101.82, a stop-loss at $99.07, and take-profit targets between $105.83 and $110.90. Source: @NotXevk via X

Market experts also point to LTC dominance metrics and trading volume trends as indicators of resilience in the market. While short-term volatility remains a factor, Litecoin’s technical patterns and increasing institutional interest provide a compelling case for potential gains. Investors are advised to monitor market signals closely and consider both technical and fundamental factors when evaluating LTC positions.

Final thoughts

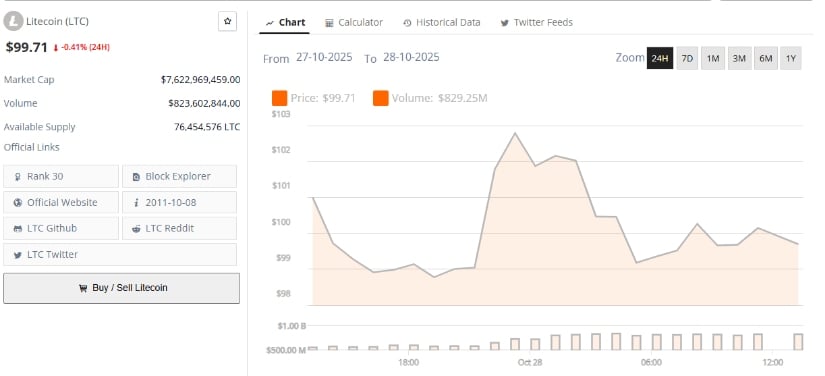

Litecoin was trading at around $99.71, down 0.41% in the last 24 hours. Source: Brave New Coin

Litecoin’s current setup highlights a pivotal moment in its price trajectory. With a symmetrical triangle pattern suggesting a potential breakout and the recent ETF launch fueling bullish sentiment, LTC appears well-positioned for gains above $150. While market volatility cannot be ignored, the combination of technical momentum, institutional interest, and broader adoption supports a positive outlook for Litecoin in the near term. Traders and investors are advised to stay attentive to price action and market developments as Litecoin navigates this critical phase.