Since New Years day we’ve seen the Bitcoin price rise from mid $16K to almost $23k.

Is this the start of a bull run, is it a fakeout, is it stop hunt for the shorts? We don’t know, you don’t know, it’s impossible to know but it’s a welcome respite from the lows at the end of last year, so long may it last, and enjoy it while it does. But Miners, be careful what you wish for.

Hardware prices have dropped significantly in the last 12 months as a result of the market capitulations, many distributors will take the earliest opportunities/excuses to put prices up on the inventory they may have purchased for more than triple current prices.

Trying to predict hardware prices is as difficult as predicting the direction Bitcoin will take next. Having been in this market for many years, we see the majority of people miss out on the low prices, sitting on the sidelines because they think it will go lower. The price volatility is still relatively low, is now a good time to buy? Maybe, maybe not, it’s still much much better than it was a year ago, but in BTC terms.

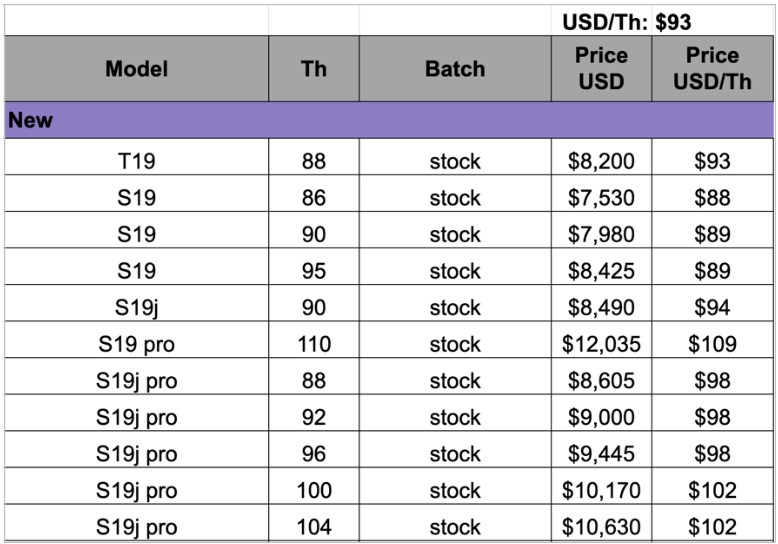

Here’s a snapshot of the hardware prices almost exactly 1 year ago:

An average $/TH price of $93. Fast forward almost exactly 12 months:

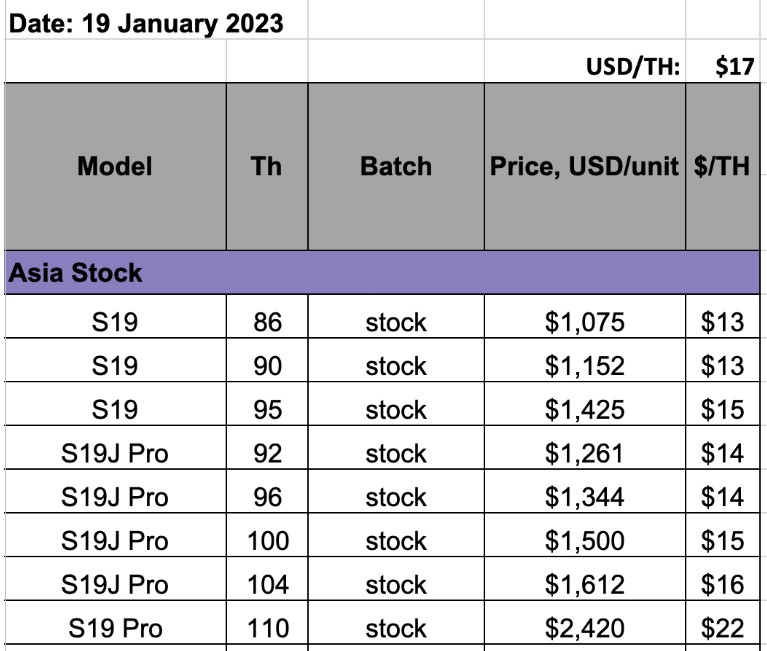

An average price of $17/TH. Over $8.5K knocked off the price off an S19J Pro 100.

If we look at the BTC price drop, on January 24th, 2022 BTC closed at $36735, on January 19th 2023 BTC closed at $21053, a YoY fall of 42%. Although none of the distributors list hardware prices in BTC I quite often like to look at hardware costs in BTC terms. On January 24th 2022 an S19J Pro 100TH would have cost $10,170, in BTC that’s ₿0.277. On January 19th 2023 an S19J Pro 100TH would have cost $1500, that’s ₿0.077. ₿0.277 (worth $5831 on January 19th) would buy just over 3 S19J Pro’s now. $10,170 would buy 6 S19J Pro’s now.

Since the beginning of 2023 hardware prices have been fairly flat, at the beginning of January an S19J Pro 100TH would have cost $1400, the price have risen by about 7%, Bitcoin has risen almost 43% in the same period of time.

In previous more bullish markets we would have seen a steeper/quicker rise in hardware prices with a rising Bitcoin price. The fact that the prices are still relatively flat is indicative of the high volumes of new and used stock hardware for sale. Usually the Asian reseller market would drive prices up, right now with lots of new and used miners still sat in boxes in the US, sellers in the US are driving the market pricing, market forces and competition keeping the pricing down, the Bitmain and Asian monopoly have weak hands right now.

S19J Pro+ 122TH

January saw Bitmain release a more efficient S19J Pro, the S19J Pro+. Bitmain are claiming it will hash at 122TH with an efficiency of 27.5J/TH, it will draw 3355W. Bitmain are selling this for $19.5/TH, $2379+shipping. We are selling these for a few $/TH less than the current Bitmain spot price, as always, please contact for pricing.

Should you buy one? Obviously many factors come into play when deciding which miner is best for you and your circumstances. Higher electricity prices or lack of space would dictate the need for increased efficiency. Are you interested in generating as many BTC as possible prior to the halving? Are you interested in real-time profitability, maybe with your current cashflow situation you can’t afford to hodl 100% of the Bitcoin generated. With new firmware likely to be released in the next few months for this model, it’s possible the efficiency could increase further by reducing the chip frequency, power consumption and lower the hashrate.

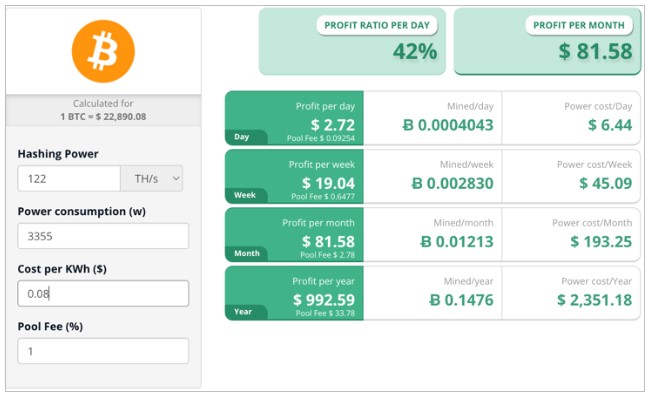

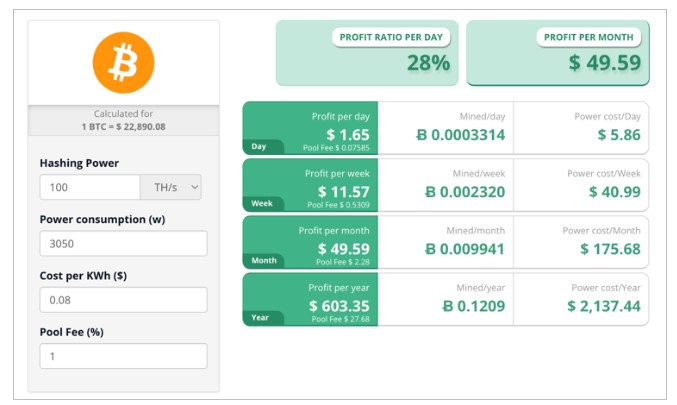

Here are a couple of examples showing how the S19J Pro+ and the existing S19J Pro 100TH based on a fairly simplistic mining profit calculator, using a power cost of $0.07/kwh:

S19J Pro+ 122TH:

The breakeven power price for this at the current BTC price and difficulty is about $0.11/KWh.

S19J Pro 100TH:

The breakeven power price for this at the current BTC price and difficulty is about $0.10KWh.

As you can see there is a $389 difference in profit per year, but right now, if you order direct from Bitmain the difference in capital outlay is $880 (please don’t do that, buy from Minerset.com, we can save you money and we are much nicer to deal with than Bitmain will ever be!).

If your electricity price is higher than $0.07 and quite a lot of people are paying more than that (for example I live in the UK and the domestic electricity price is over $0.4/kwh, and no, I don’t mine here), the S19J Pro+ starts to make more sense, as does deploying S19J Pro or S19’s with non-standard configurations to improve their efficiency and profitability.