How to Earn Bitcoins Through Mining: A Quick Guide

Below, we’ll explore changes in cryptocurrency mining, Bitcoin’s prospects, and the factors driving this bull run. If you’re eager to start mining right away, here’s a step-by-step guide.

Here’s what you need to do to configure your GPU for mining and, if needed, convert the mined coins into bitcoins:

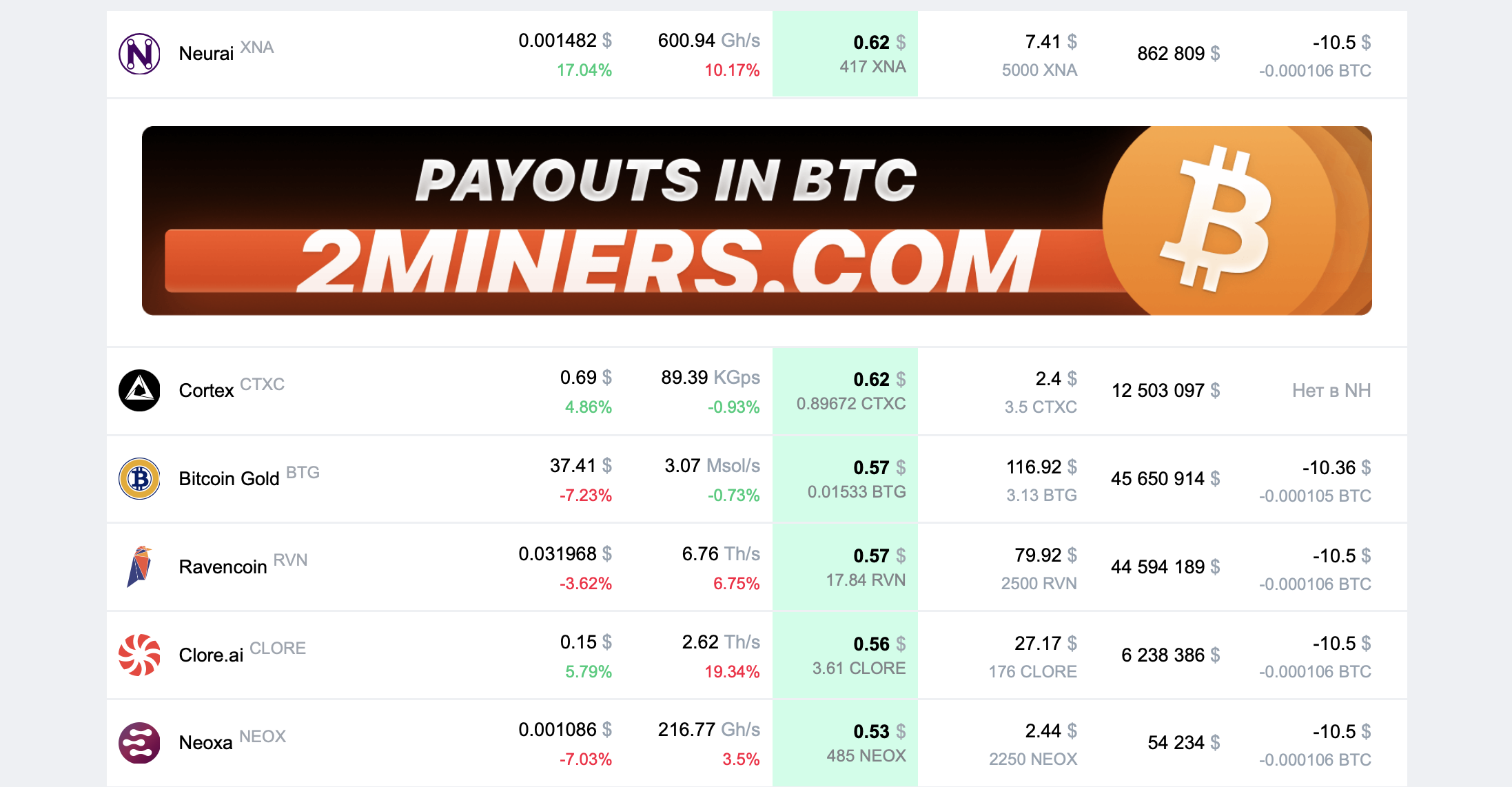

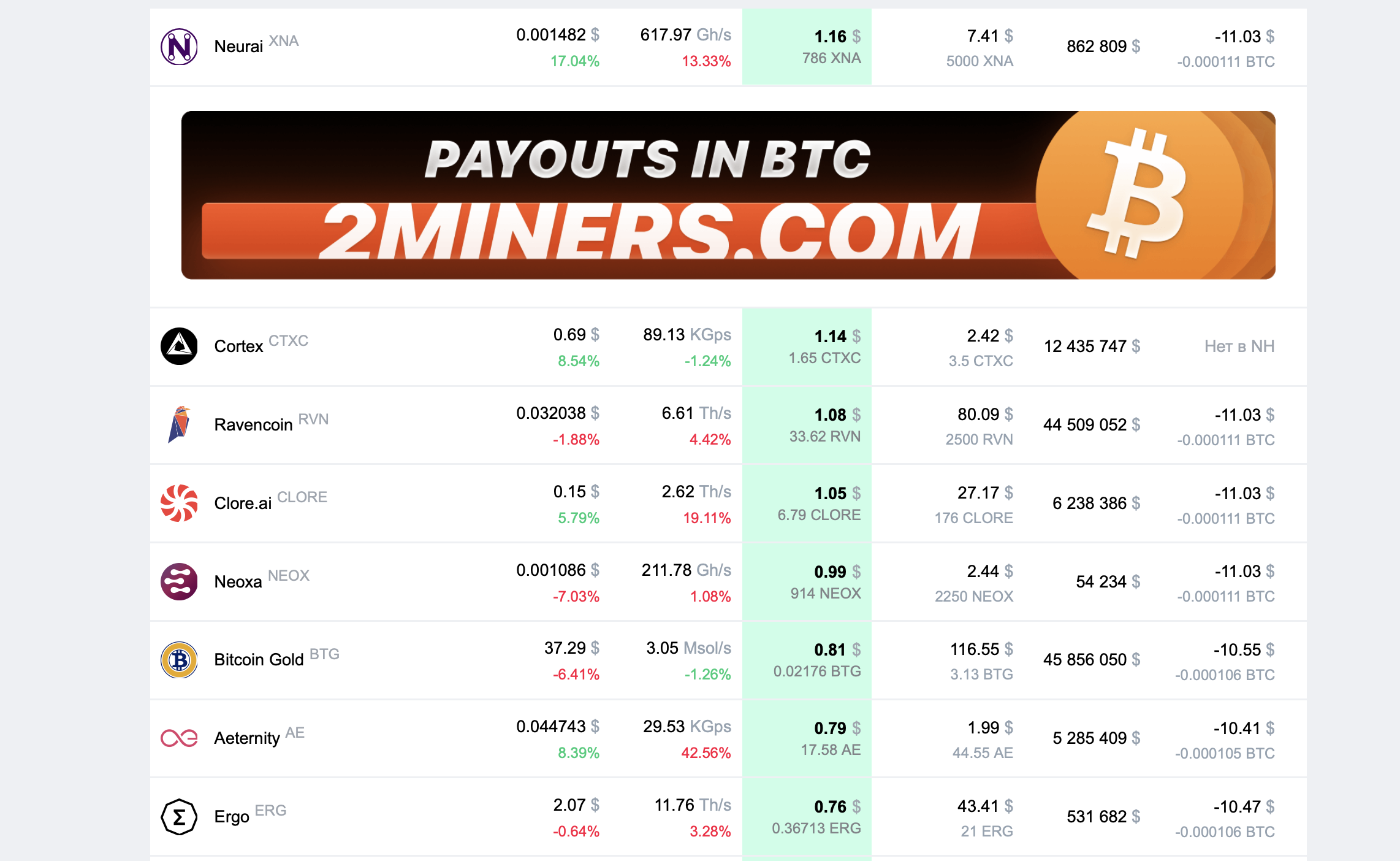

Visit a mining profitability calculator and enter your GPU model—for example, Nvidia GeForce RTX 3070. Select your GPU to view a list of the most profitable cryptocurrencies to mine.

For instance, Naurai XNA mining generates about $0.62 daily (excluding electricity costs). What’s next?

- Open the Naurai XNA mining help page.

- Create a wallet using the provided links. If you prefer, use an address from a cryptocurrency exchange.

- Download a mining program from this archive (password: 2miners). For Nvidia GPUs, choose T-Rex or GMiner; for AMD GPUs, use NBMiner or TeamRedMiner.

- Edit the .bat file to include your wallet address. If you want the mining pool to automatically convert your rewards into BTC and send them to you, specify a Bitcoin address.

- Run the miner, leave your computer running, and enjoy receiving coins over time. If you’ve specified a Bitcoin address, the payouts will be in BTC.

We’ve detailed the process of earning bitcoins through mining in a separate article. Check it out if you’re new to mining.

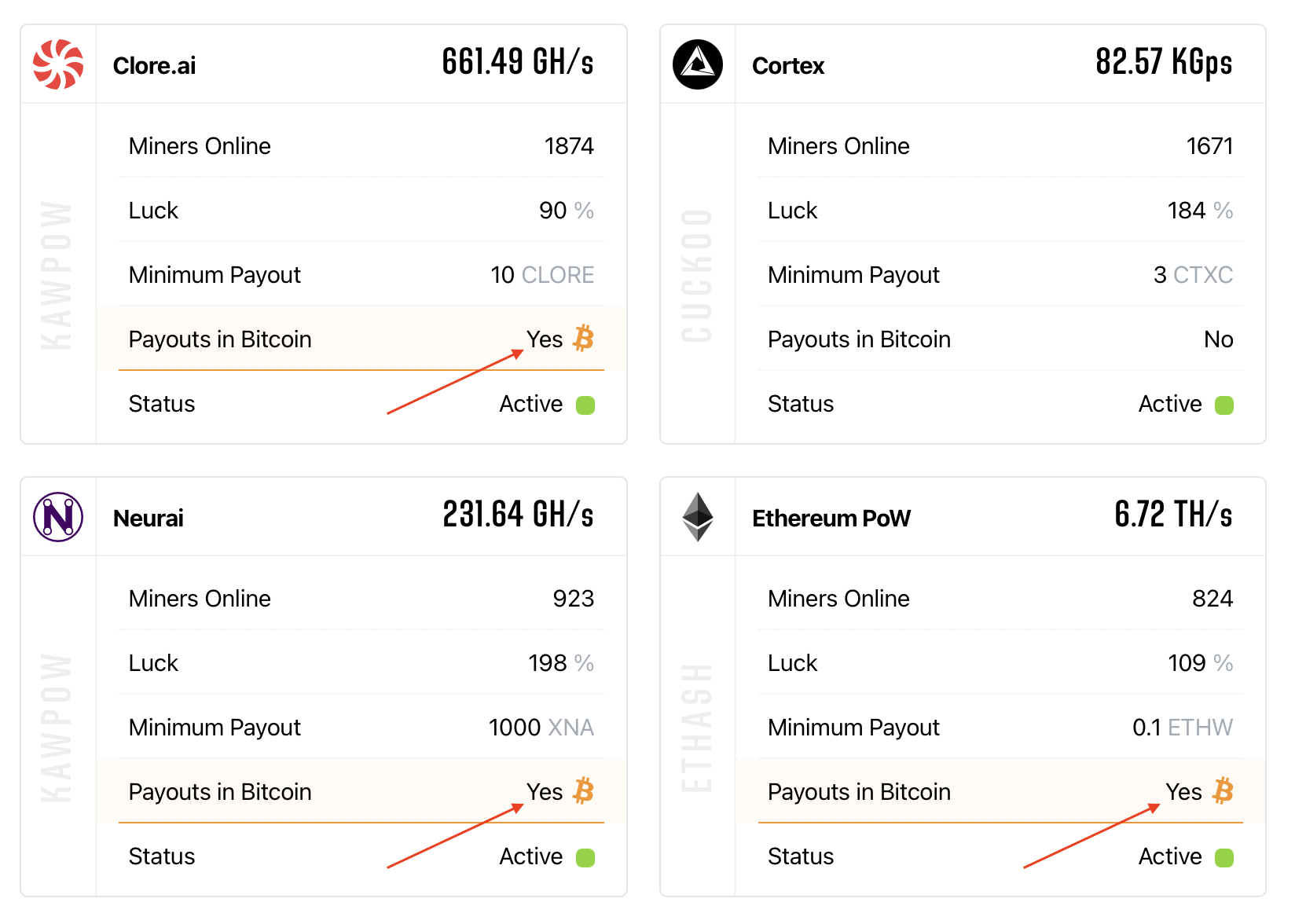

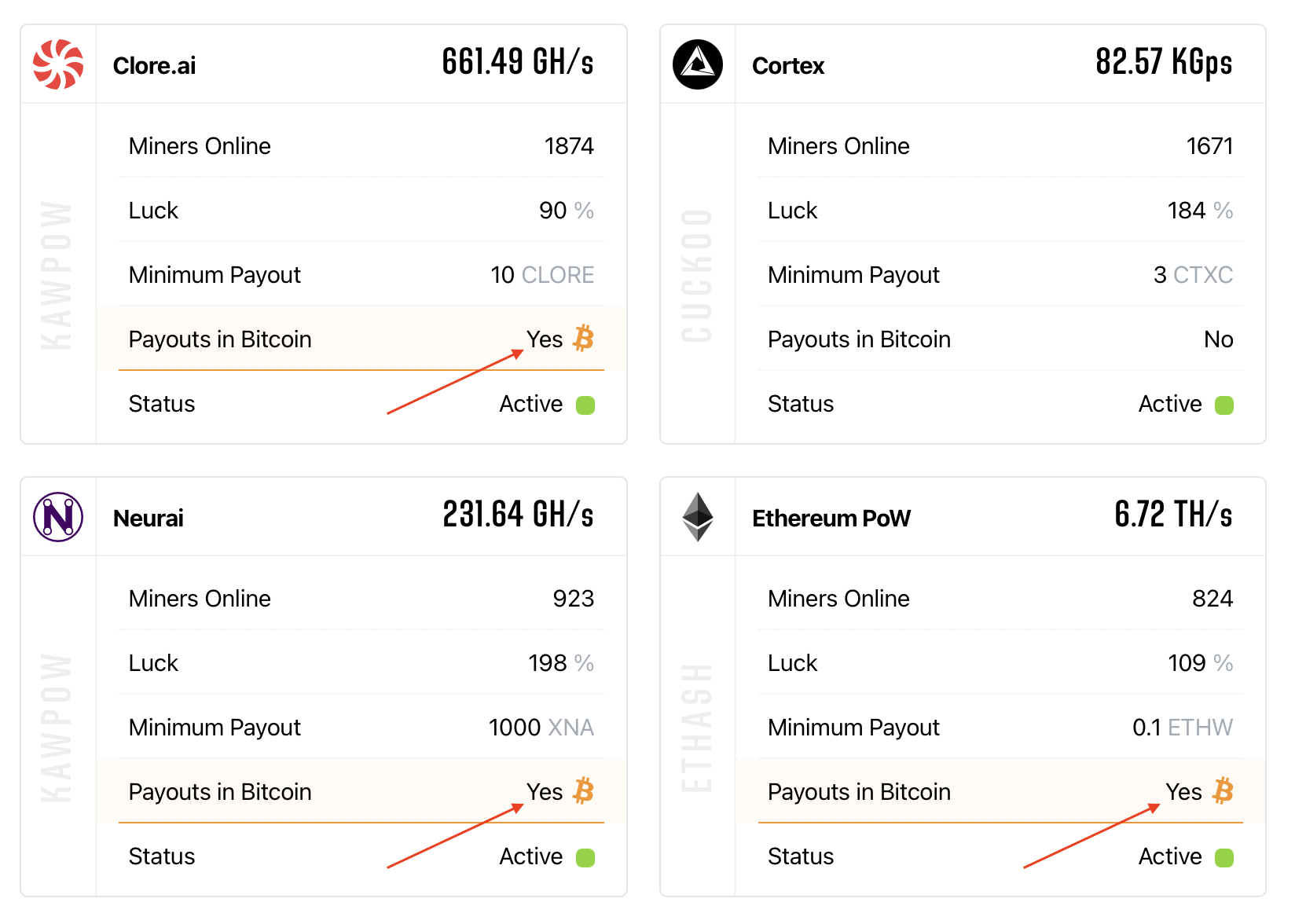

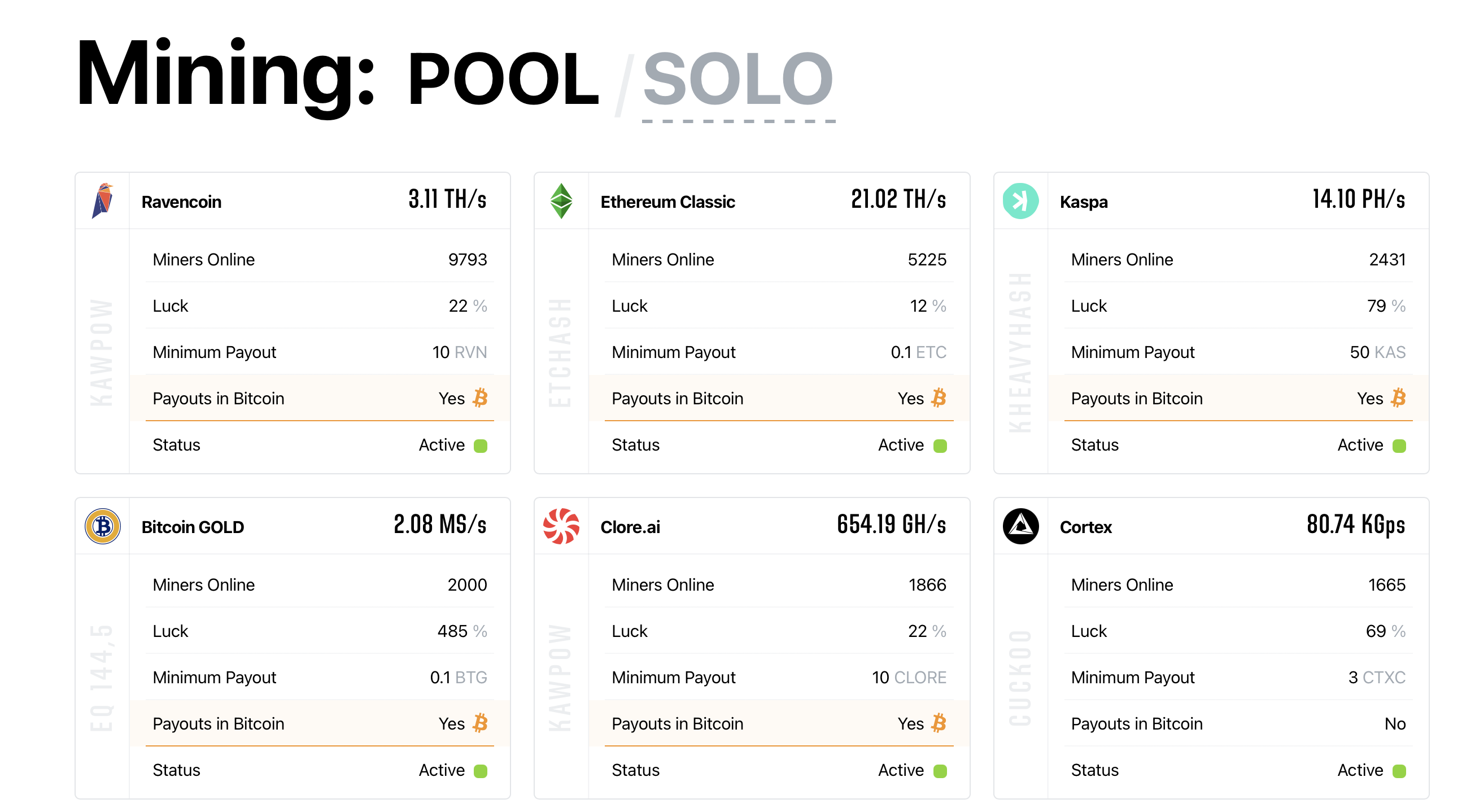

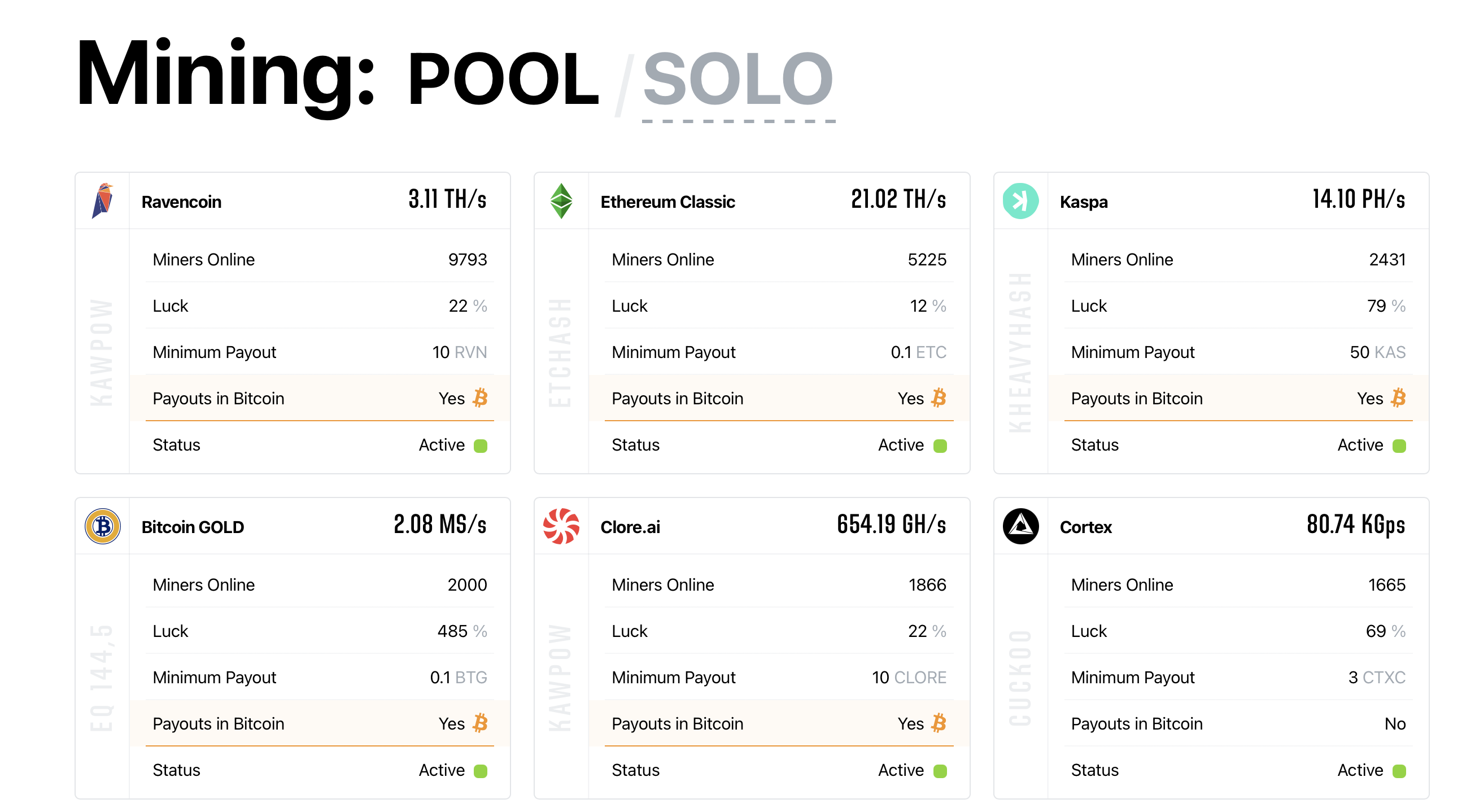

Most coins on the 2Miners pool allow BTC payouts. You can check for this feature on their homepage.

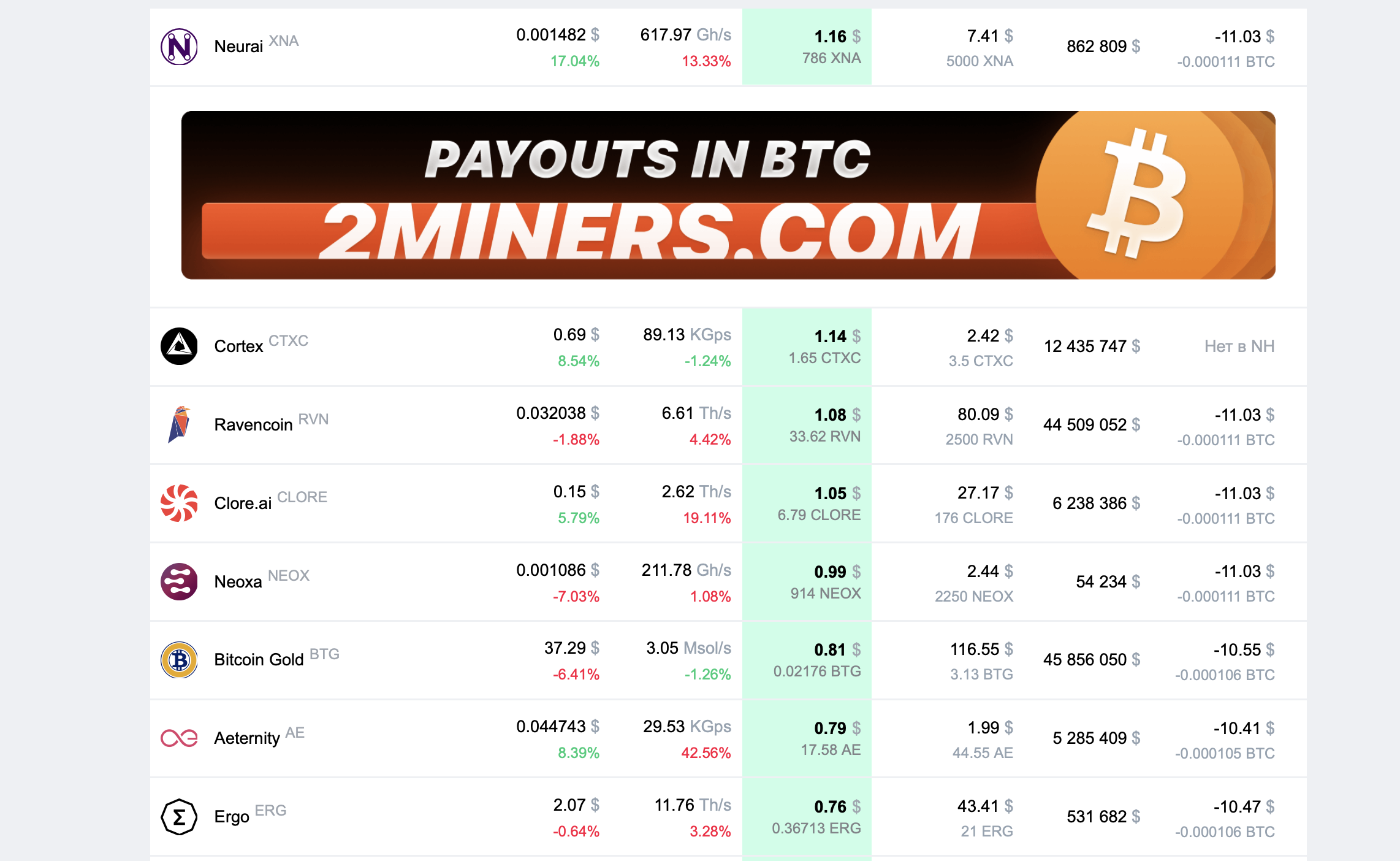

How much can you earn in dollars through mining? Use the calculator with a more powerful GPU, like the Nvidia GeForce RTX 3090.

Currently, this GPU earns about $1.16 daily. After electricity costs (which vary by location), you can expect approximately $30 monthly or $350 annually.

Is this extra income worthwhile? Definitely. Can Bitcoin or other coins grow by tens or hundreds of percent in months? Absolutely.

Start mining now to capitalize on the bull run. Remember, the bull market won’t last forever, so your GPU won’t need to run for an entire year.

Now, let’s dive into the details.

What’s Changed in Cryptocurrency Mining Over the Years?

Ethereum used to dominate mining due to its accessibility with GPUs instead of noisy, specialized ASICs. However, in September 2022, Ethereum transitioned to a Proof-of-Stake (PoS) consensus algorithm, eliminating GPU mining.

Validators now secure the network by locking 32 ETH in a deposit contract, running validator clients, and performing tasks previously handled by miners. Users can also join staking pools with smaller amounts of ETH.

This shift left millions of GPUs unemployed, prompting their owners to mine other cryptocurrencies, significantly reducing profitability.

Despite these challenges, mining has evolved, with new Proof-of-Work (PoW) projects emerging. These coins are traded on exchanges, making it easy to convert mining rewards into everyday essentials.

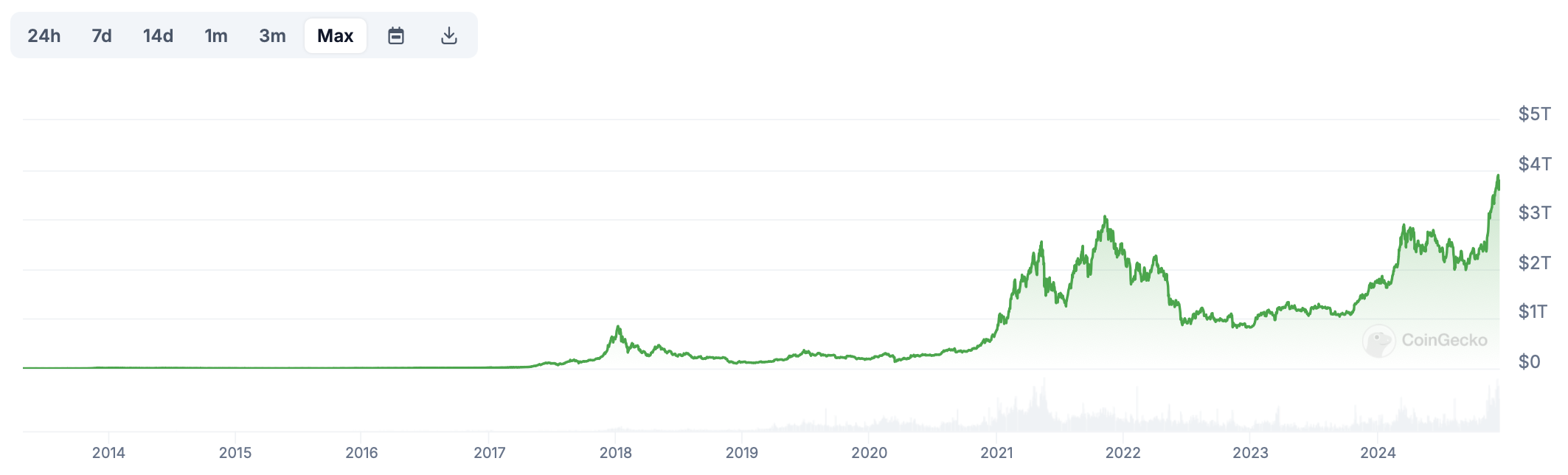

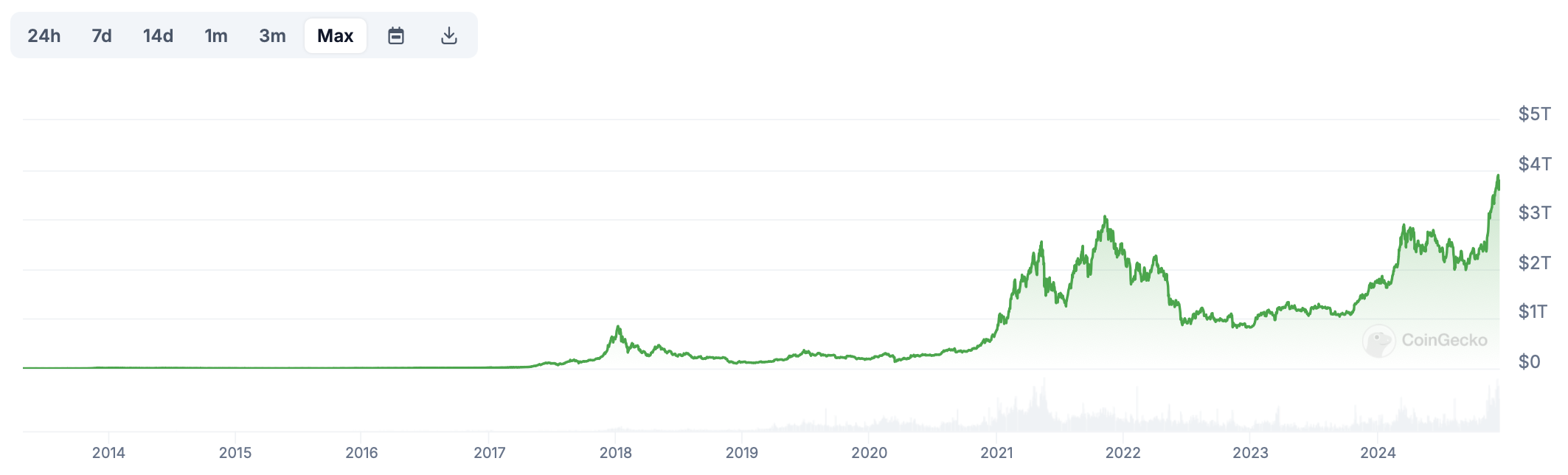

Cryptocurrencies are now experiencing rapid growth, attracting new investors. For instance, the crypto market capitalization has surpassed previous all-time highs from 2021 and continues to climb.

What Can Bitcoin’s Peak Price Be This Cycle?

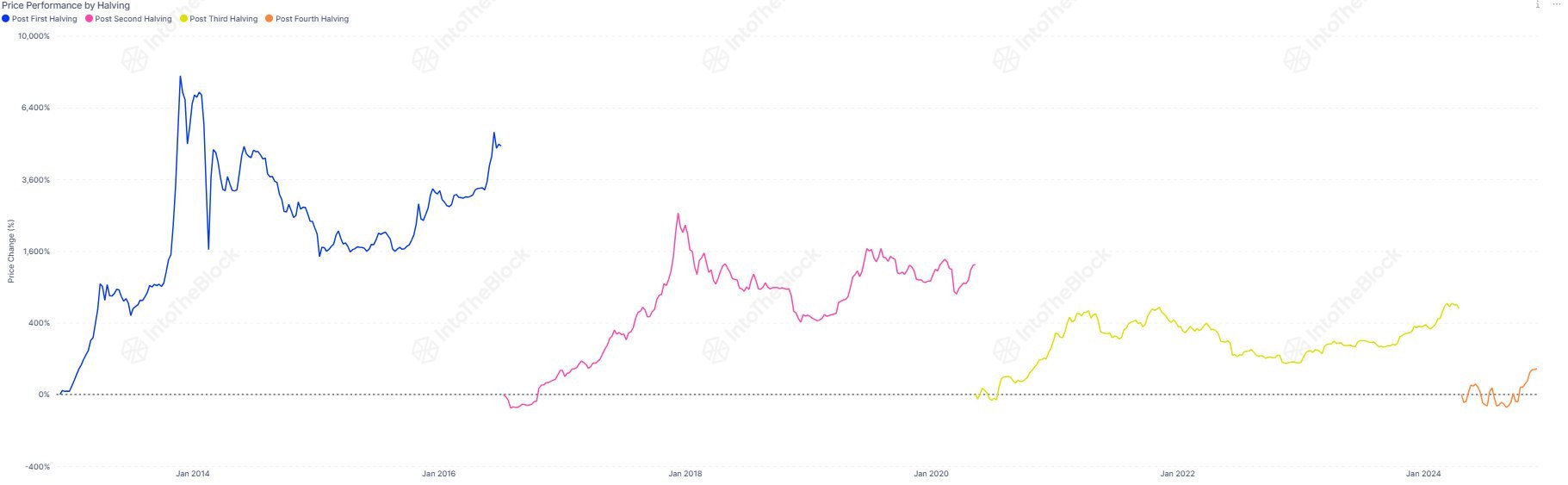

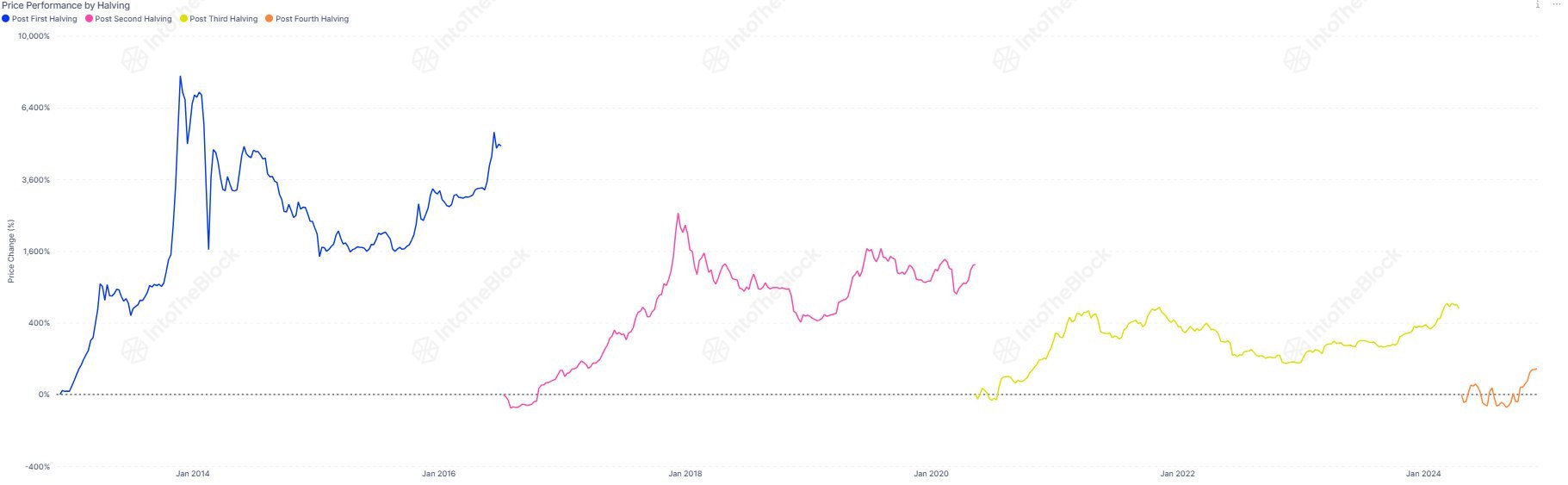

Analysts at IntoTheBlock studied Bitcoin’s past performance, examining growth after halving events (block reward reductions occurring every four years):

- 2013 cycle: Bitcoin grew by 7,900%.

- 2017 cycle: Bitcoin surged by 2,560%.

- 2021 cycle: Bitcoin rose by 594%.

With each cycle, Bitcoin’s growth rate decreases due to its growing market capitalization, now at $1.9 trillion. IntoTheBlock analysts predict BTC could rise 100–200% from its April 2024 halving price, potentially reaching $130,000–$190,000 this bull run.

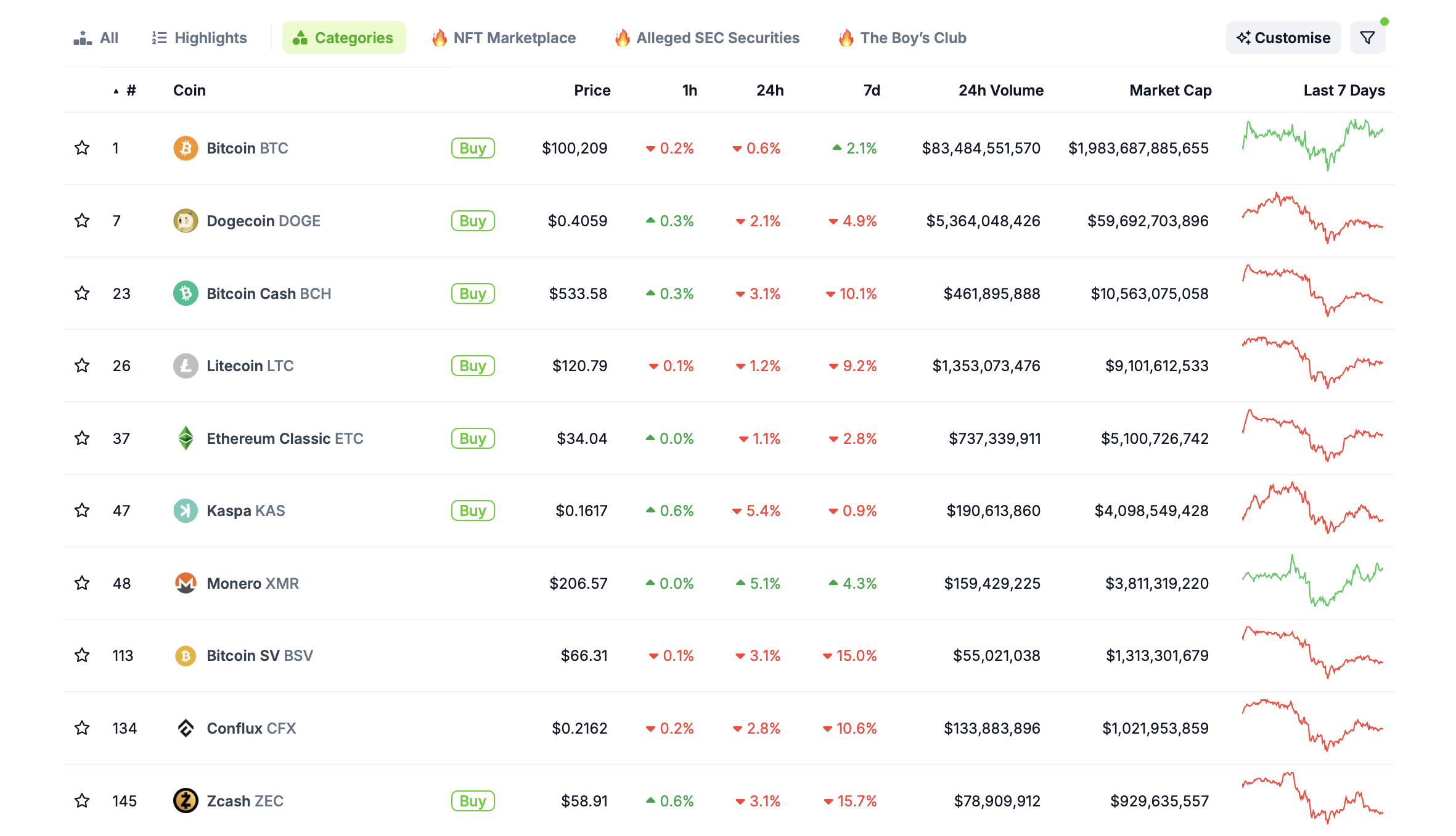

Which Coins Can You Mine in 2025?

There are plenty of PoW coins to mine. Here’s a list of popular options with significant market caps, led by Bitcoin.

Their combined market capitalization is $2.08 trillion, with a daily trading volume of $92 billion.

On the 2Miners pool, favorites include Ravencoin, Ethereum Classic, Kaspa, Clore, Cortex, and others. For profitability, use the 2CryptoCalc tool.

Ravencoin surged 44% in a month, ETC rose 56%, Clore jumped 43%, and Cortex delivered 239% monthly growth. Meanwhile, Kaspa (KAS) saw its price multiply by 11x within 18 months.

Exactly a year and a half ago — June 6, 2023 — 1 KAS was worth just 1.4 cents. Today, the coin is valued at $0.16, marking an elevenfold increase. And that’s far from the cryptocurrency’s all-time high.

Experienced players might well hold onto their mined altcoins and sell them later. Sudden spikes in coin values are not uncommon in the crypto industry.

Why mining still makes sense

Some people might think it’s already too late to get involved with coins, believing their first purchase will inevitably trigger a market crash or even usher in a bearish trend in crypto.

However, that’s not entirely true, as there are plenty of reasons to expect the bull run to continue.

Here they are:

- Donald Trump won the U.S. presidential election. During his campaign, he expressed support for the crypto industry and promised to implement reasonable regulations for digital assets in the country. This would be unprecedented in America, leading investors to anticipate further global adoption of cryptocurrencies.

- The leadership of the Securities and Exchange Commission (SEC) is set to change. The new chairman will be Paul Atkins, known for his favorable stance toward cryptocurrencies. It’s reasonable to assume that the SEC will put an end to the pointless lawsuits against numerous blockchain companies that have plagued the industry in recent years.

- Earlier it was announced that Trump has chosen a candidate for the position overseeing AI and cryptocurrency policy. The role will be filled by former PayPal COO David Sacks, who will focus on developing the country’s cryptocurrency regulatory framework.

- There’s ongoing discussion in the U.S. and other countries about creating national Bitcoin reserves. For example, a bill proposed by Senator Cynthia Lummis suggests acquiring one million BTC to be held for at least 20 years.

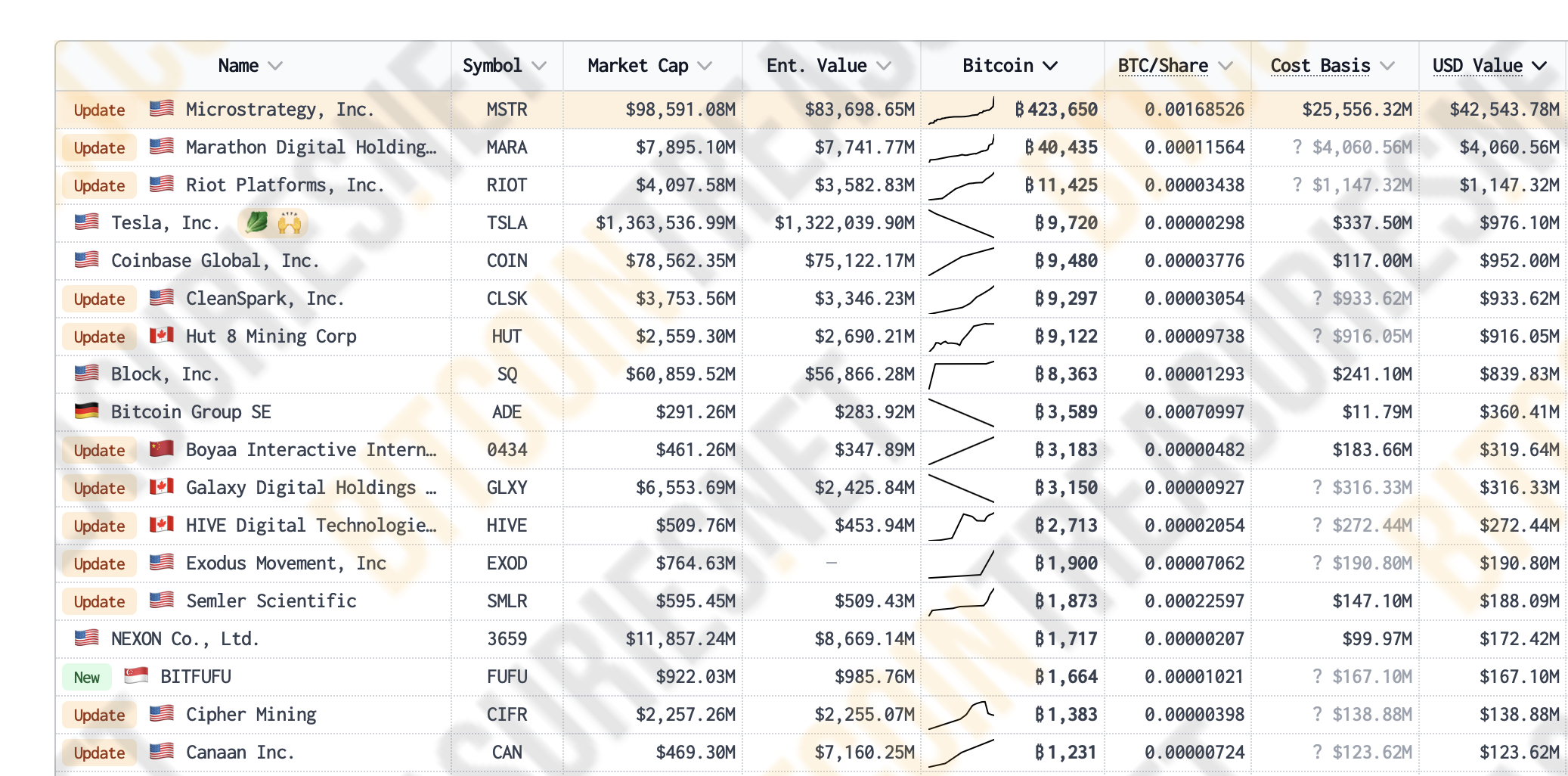

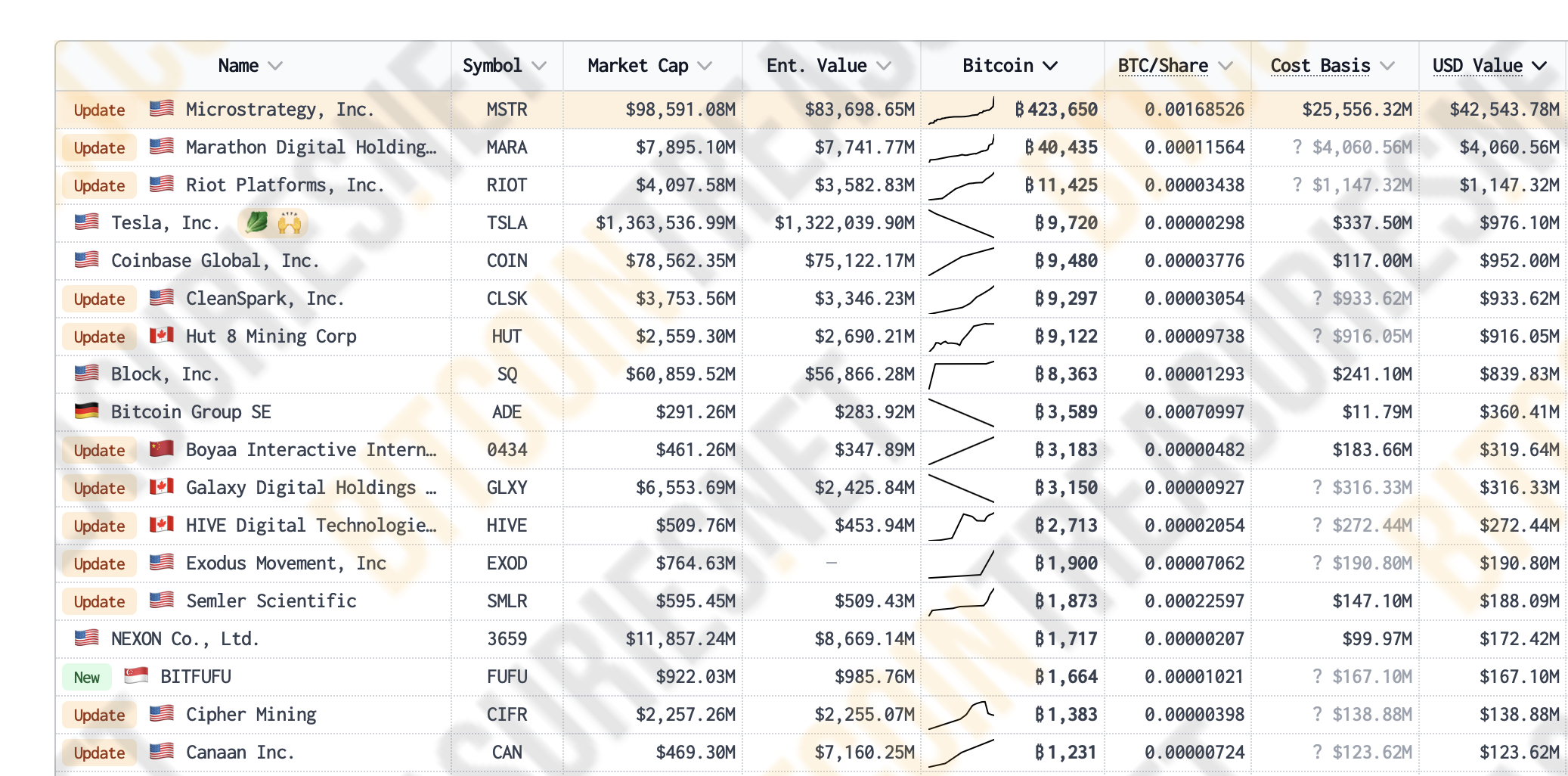

- MicroStrategy, led by Michael Saylor, continues to make massive investments in Bitcoin. On Monday, the company announced the acquisition of 21,550 BTC worth $2.1 billion. Moreover, it plans to raise an additional $42 billion in the coming years to purchase more coins.

The current optimism in crypto sometimes leads to absurd price surges. A prime example in recent weeks has been XRP by Ripple.

This month alone, the coin has jumped by 251%, multiplying in value several times. Here’s what XRP’s chart looks like over the past year:

Accumulating Bitcoin and other cryptocurrencies under current conditions seems like a solid idea.

Should You Convert Mining Rewards to Bitcoin?

Some crypto investors are hesitant to engage with altcoins — that is, any coins other than Bitcoin. While altcoins often offer higher returns, this cautious approach is understandable.

First, altcoins tend to have greater volatility, meaning their prices fluctuate much more frequently — including downward. This makes them more unpredictable. New investors are unlikely to be prepared for such swings, so starting their crypto journey with Bitcoin is a reasonable choice.

Second, long-term investments in altcoins are riskier than those in Bitcoin. Many altcoin projects fail to survive market downturns or so-called bear trends. They lose investor interest, see trading volumes drop to mere hundreds of thousands of dollars, and eventually, the coin may become irrelevant.

A way to mitigate this risk is through the unique feature of the 2Miners mining pool: Bitcoin payouts. As mentioned earlier, rewards earned in other coins can be automatically converted to BTC and sent to the designated wallet address.

However, if you have experience investing in diverse cryptocurrencies and the skill to sell them at pre-determined price levels, mining altcoins can still be a viable option.

Conclusion: Why Mining is Worth Trying

A bull run is the best time for cryptocurrency mining. Coin prices are actively rising, mining generates no losses, and it even allows you to accumulate coins. These coins, in turn, can be automatically converted into Bitcoin.

A prime success story is MicroStrategy. The company invested $25.5 billion in its 423,650 BTC holdings to date, and their value has now grown to $42.5 billion. This means unrealized profits of nearly $17 billion, making the risks of a novice mining new coins seem negligible compared to MicroStrategy’s bold strategy.

Moreover, mining is relatively simple and won’t burn out your GPU. As a bonus, you’ll receive a steady stream of Bitcoin, which can be safely held for several years without fear.

As always, we remain committed to supporting your mining activities. Stay updated through our X (Twitter) and Telegram miner community. Happy mining!