Solana Price Prediction suggests a bullish trend as institutional interest and technical signals point to a potential rise to $180.

Solana is back in the spotlight, but this time the narrative feels different. It’s not just chart watchers getting excited; regulators, institutions, and traditional firms are stepping into the mix. From Canada’s approval of the first spot Solana ETFs to a $4.6 million buy from real estate firm Janover, the groundwork for something meaningful is being laid, and it’s already fueling fresh Solana Price Predictions across the market.

Solana ETFs Get the Green Light in Canada

In a major step for crypto adoption, Canada is set to launch the world’s first spot Solana ETFs on April 16, as reported by Eric Balchunas. The Ontario Securities Commission has approved several big names, including Purpose, Evolve, CI, and 3iQ, to offer Solana ETF to the market.

Solana ETFs approved in Canada, marking a significant milestone for institutional and retail adoption. Source: Eric Balchunas via X

While this may not have the same hype as Bitcoin ETF headlines, it’s still a pretty big milestone for Solana. Giving institutional and retail investors easier access to SOL exposure, alongside staking rewards, adds long-term utility to the asset.

Solana Stablecoin Surge Hits Record $12 Billion

Following Canada’s green light for spot Solana ETFs, Cointelegraph reports that real estate firm Janover has stepped in with a $4.6 million buy, marking its first SOL purchase as part of a newly revamped treasury strategy. While headlines often chase hype, this one’s different. Janover isn’t a crypto native, it’s a traditional firm signaling something deeper: a calculated shift toward blockchain assets with real-world utility.

Traditional firm Janover makes its first Solana purchase. Source: Cointelegraph via X

With spot ETFs opening the door for easier Solana exposure, Janover’s buy could be the first of many from traditional institutions. Moves like this often fly under the radar at first, but they tend to spark something bigger later on. Janover might just be the first ripple in a wave of new demand.

Solana Price Prediction: Eyes on $180 as Structure Turns Bullish

Janover’s 4.6m buys and Canada’s green light for Solana ETFs has pushed Solana’s price into a breakout above a long-standing downtrend line. The breakout flips a key technical resistance, hinting that $180 may be more than just a chart dream. Famous crypto analyst Jesse Peralta suggests that price is now riding above both the trendline and key moving averages, creating a more convincing technical case. Traders will be watching to see if the SOL Solana price can flip the $150 zone into support.

Solana breaks key resistance with eyes on $180, as technicals and fundamentals finally align. Source: Jesse Peralta via X

Momentum is now pairing with fundamentals. With liquidity flowing in and market structure shifting, this move has stronger legs than most relief rallies we’ve seen in recent months. There is now a clear sign of alignment between Solana’s on-chain activity and its recent price action.

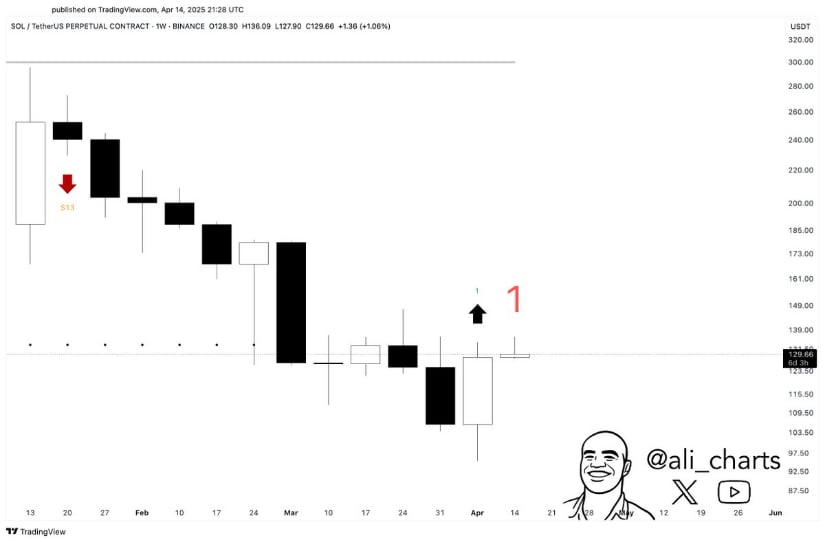

Solana Weekly Buy Signal: Key Resistance Breakout and TD Sequential Setup

After breaking above key resistance and riding the momentum from ETF approval and Janover’s buying, Solana Price Prediction is turning heads again with a fresh technical signal flashing.. Analyst Ali Martinez points out a TD Sequential “buy” setup forming on the weekly chart, often seen at potential trend reversal zones. This setup historically carries weight, especially when paired with broader bullish developments.

Weekly TD Sequential buy signal flashes for Solana. Source: Ali Martinez via X

If bulls maintain control, the next resistance sits around $160, followed by a psychological barrier near $180. A confirmed weekly close above $153 would add confidence to the setup, flipping it from potential to actionable. On the downside, $128 remains a key support to watch for invalidation. Momentum is building, but the structure needs follow-through to lock in this reversal.

Solana Price Holds Steady: Is a Pullback the Calm Before the Breakout?

SOL Solana price is consolidating just below $130, but the chart suggests this might just be a pause before the next move. Price is hovering above a key demand zone near $120 to $122, which lines up with the 200 EMA on the 2-hour chart. This level has held up well and could act as a springboard if revisited. The dotted projection from crypto analyst Deda hints at a possible dip into that support before a potential bounce, setting up a “reclaim and go” scenario if buyers step in again.

Solana hovers near $130 as analysts eye a bullish bounce from the $120 demand zone. Source: Deda via X

With momentum from the ETF approval in Canada and backing fundamentals, this technical pullback wouldn’t necessarily be a bearish sign; it might just be the reset needed. If bulls can defend the $120 area and push for a close above $135, the next stop could be $150.

Final Thoughts

Solana’s setup is strengthening across the board. ETF approvals, stablecoin inflows, and traditional firm interest are creating a solid backdrop for SOL Solana price momentum.

While short-term pullbacks are always in play, the broader structure now leans bullish. If key support zones hold and volume continues to build, Solana Price Prediction targets like $150 and even $180 remain achievable. It’s not just about one catalyst, rather, it’s the convergence of institutional adoption, technical confirmation, and growing on-chain activity that’s setting the stage for a potential rally.