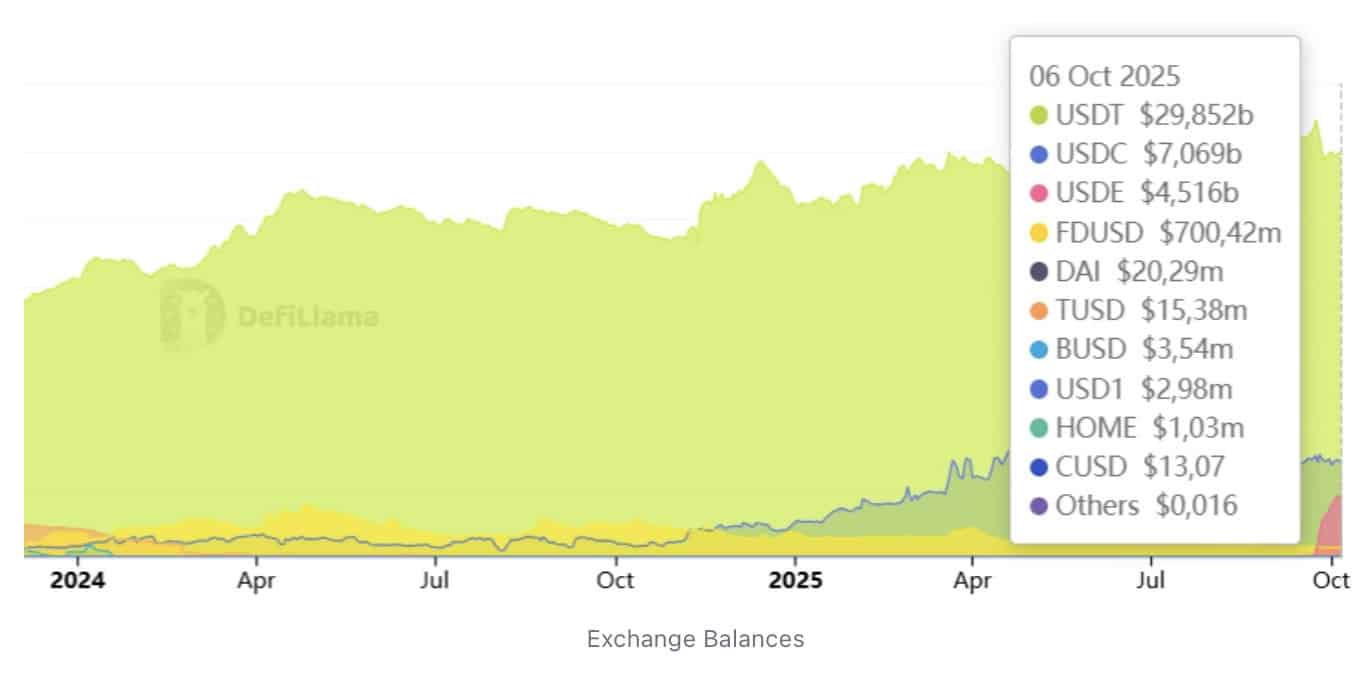

The total stablecoin market cap has soared past $300B for the first time ever.

Nearly 300 projects across several different chains have contributed to the figure, as regulatory clarity encourages traditional firms to adopt stablecoins.

The trend is expected to gather more speed in the coming months.

However, being pegged to fiat currencies, the value of stablecoins doesn’t reflect the market’s growth. This gap is steering strategic investors to other crypto infrastructure projects that capture the rising on-chain activity.

What’s Driving Stablecoin Adoption

Stablecoin market dynamics have changed rapidly over the last few years.

For example, Tether’s $USDT market share dominance has shrunk from 86% in June 2020 to 58.5% in October 2025. Meanwhile, Circle’s $USDC has spiked from 7% to nearly 25% in the same timeframe.

Stablecoin market share, source: DeFillama

But that’s not the most interesting part. The Tether-Circle stablecoin duopoly is starting to wane as more issuers emerge.

There are multiple catalysts behind the shift.

Governments are taking initiatives to clear the ambiguity surrounding stablecoins. Notably, Donald Trump signed the GENIUS Act into law on July 18, 2025, creating a friendly regulatory framework for stablecoins in the US.

The clarity encourages new players – both issuers and users – to step into the market with confidence.

And it’s not just banks and large institutions exploring their own stablecoins.

High yields motivate crypto exchanges and fintech platforms to launch their own stablecoins as well. That’s because they earn close to nothing from deposits held in top stablecoins, as Tether and Circle have long kept the large returns from their reserve assets to themselves.

Stablecoin exchange balances, source: DeFillama

‘If you are a crypto exchange with $500m in $USDT deposits, Tether is earning around $35m/year on that float, and you’re getting nothing,’ as Castle Island partner Nic Carter explains in a recent article. It’s easy to see why more players are eager to unlock this revenue stream.

The entry barrier to the market is falling, too, thanks to cheaper infrastructure. Using platforms like Bridge and Anchorage, anyone can launch their own branded stablecoins without heavy capital or complex backend systems.

But Eneko Knorr, CEO and co-founder of Stabolut, points out that ‘the most important reason for this growth is that people in finance now understand how useful stablecoins are in the real world.’

Cross-border transactions through traditional channels are ridiculously slow and expensive compared to stablecoin transfers.

Even so, stablecoin deposits mirror the value of the underlying fiat, not the expansion of the crypto industry. As Uptober unfolds, investors are actively seeking returns in other crypto infrastructure projects to capture this growth.

Investors Stock up on $BEST as Stablecoins Expand

$BTC recently hit an ATH of $126K, kicking off what could be an explosive Uptober rally.

So, it’s not just stablecoins that are seeing rapid adoption. The broader cryptocurrency market is booming, as crypto policies become more favorable and institutions confidently enter the space. In particular, utility coins that are building next-gen crypto infrastructure are on investor radars.

The growing capital flow into early-stage projects like Best Wallet Token ($BEST) confirms the trend.

The token powers Best Wallet – a multi-chain, non-custodial crypto wallet for popular cryptocurrencies and stablecoins, secured with Fireblocks’ MPC technology.

While most crypto wallets focus on storage, Best Wallet goes beyond that. The platform is building a beginner-friendly crypto ecosystem for swapping, staking, spending, fundraising, and much more.

For example, the upcoming Best Card is designed to support everyday shopping. It will be like a debit card, but instead of fiat currency, you will use stablecoins and cryptocurrencies to make payments.

The feature-rich ecosystem has won a thriving community of hundreds of thousands of happy users on both Android and iOS. However, upcoming features like Best Card could further drive its native token adoption.

According to this Best Wallet Token price prediction, $BEST could jump roughly 101% from its current presale price ($0.025755) by the end of the year and 458% in 2026.

This is because $BEST fuels all transactions in the Best Wallet ecosystem, from fees to rewards. The platform also unlocks a wide range of perks for early token holders, as shown below.

There isn’t much time left to grab $BEST for this low price, however, as the next price hike is just one day away. Attractive staking deals also await early investors – currently at 81% APY.

Join the $BEST presale now to unlock the best price and staking deals.

Disclaimer: This content has been supplied by a third party contributor. Brave New Coin does not endorse or promote any products or services mentioned herein. Readers are encouraged to conduct independent research before making any financial decisions. The information provided is for informational and educational purposes only and should not be interpreted as investment advice.