Thumzup Media Corporation has broadened its crypto treasury strategy to go beyond Bitcoin, adding six additional digital assets to its reserve allocation.

The Nasdaq-listed marketing tech firm, which previously focused on BTC, will now include Ethereum, XRP, Solana, Dogecoin, Litecoin, and USDC in its treasury holdings.

The board of directors approved the expanded asset list, signaling a shift toward diversified crypto reserves. The move allows the company to hold up to 90% of its liquid assets in digital currencies, no longer limited to Bitcoin alone.

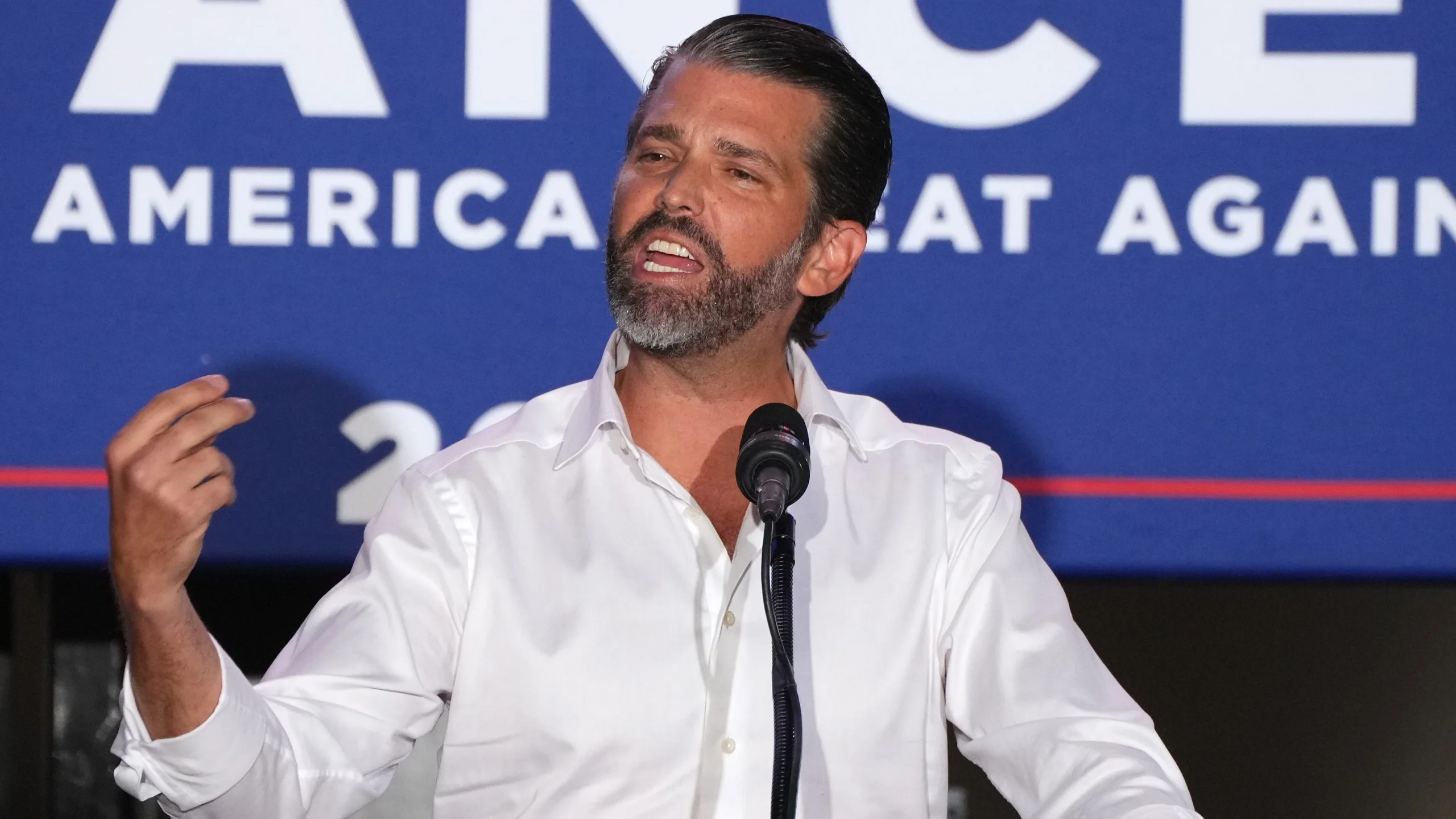

Thumzup is also making headlines due to its shareholder profile. Donald Trump Jr., son of U.S. President Donald Trump, reportedly holds 350,000 shares in the company — a stake valued at around $4 million. His involvement adds another layer to the Trump family’s growing interest in corporate crypto treasuries.

Earlier this year, Eric Trump joined the advisory board of Japan’s Metaplanet, a firm known for aggressively acquiring Bitcoin for its balance sheet.

This development follows a broader trend of businesses adopting altcoins like ETH and XRP as part of their long-term financial strategies, joining Bitcoin in the push to integrate crypto into corporate reserves.