Investor confidence in XRP is strengthening as whales accumulate hundreds of millions worth of tokens and liquidity clusters form above current levels.

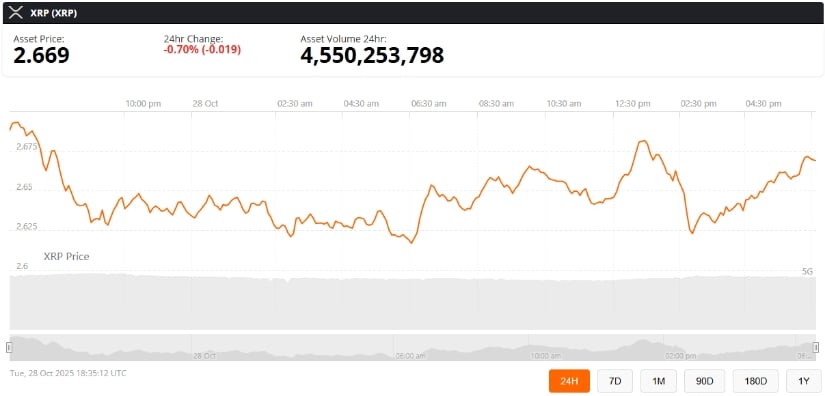

With XRP trading around $2.67 and the market eyeing the $3.60 breakout zone, the asset’s next move could determine whether this bullish wave matures into a full-scale rally.

XRP Approaches Critical Resistance Levels

According to crypto analyst Stephanie Starr (@StephanieStarrC), XRP is at a pivotal point. “This has been a level of resistance since early July. I will not get overly excited until we clear $3.22 and $3.60,” Starr noted. XRP recently tested $2.68, reflecting its struggle to break through long-standing resistance while maintaining support near $2.50.

XRP hits a critical resistance zone—watching $3.22 and $3.60 for the next breakout! Source: @StephanieStarrC via X

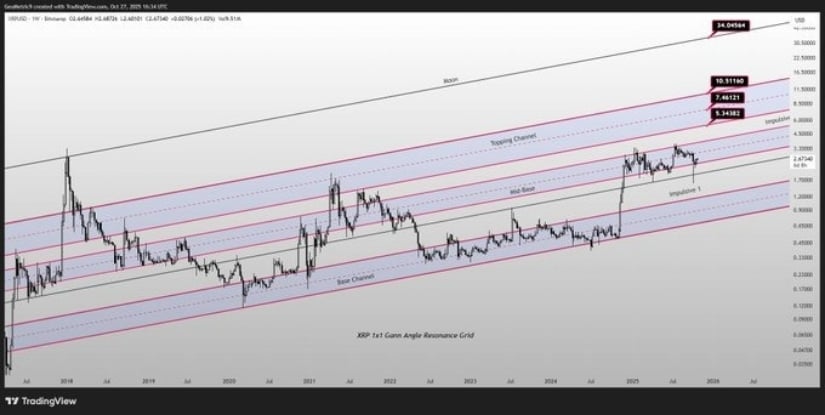

Technical charts from Bitstamp highlight ascending trend lines and repeated attempts to surpass resistance. Analysts suggest that a successful close above $3.22 could pave the way for a breakout toward $3.60. If momentum is sustained, some projections even anticipate a potential bull flag toward $4.50.

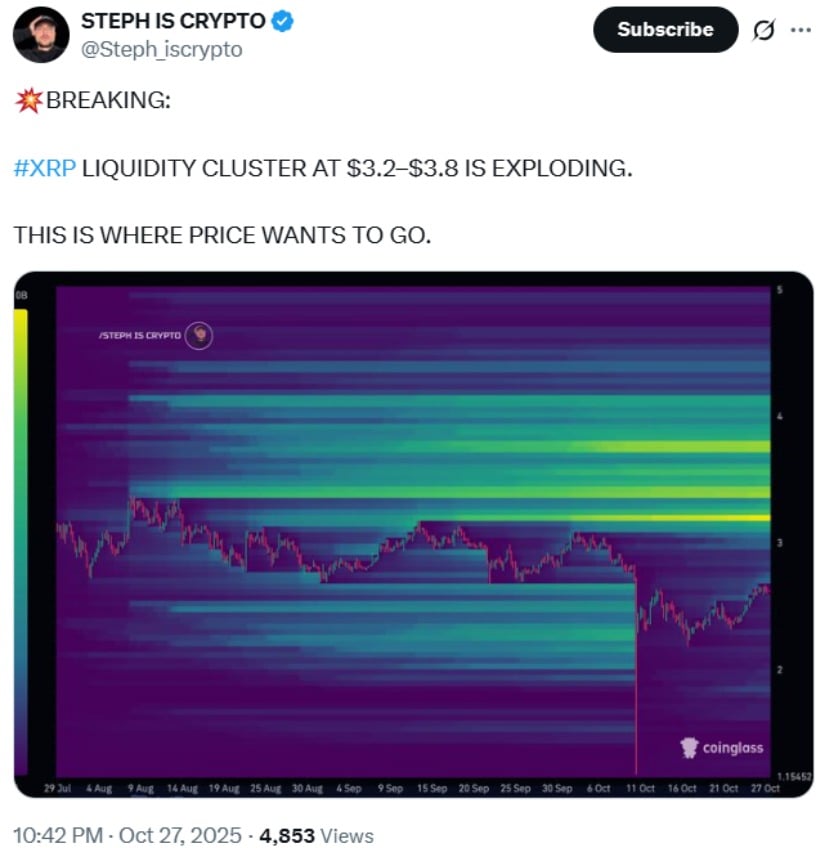

Liquidity Clusters Signal Potential Upside

A recent analysis from Steph is Crypto (@Steph_iscrypto) highlights a dense liquidity cluster for XRP between $3.2 and $3.8. “This is where price wants to go,” the post noted, emphasizing the importance of accumulated orders in fueling breakouts.

XRP’s $3.2–$3.8 liquidity cluster is exploding—target zone in sight! Source: @Steph_iscrypto via X

Liquidity clusters often act as magnets for price movement, attracting leveraged positions and triggering stop sweeps that can accelerate short-term rallies. On-chain data confirms heavy positioning in this range, signaling strong market interest.

Whale Accumulation Boosts Market Confidence

In October 2025, whales acquired $560 million in XRP, signaling strong institutional confidence in the asset. This significant accumulation points to potential upward momentum as large holders position themselves ahead of possible breakouts.

The XRP mid-base channel shows accumulation—holding here hints at upside, but breaking below could spark concern. Source: @GeoMetric_9 via X

Ripple’s ongoing advisory expansions and ecosystem developments have further reinforced optimism among traders and investors. Combined with on-chain data showing heavy leveraged positioning, XRP’s market activity suggests that both short-term gains and long-term growth are being closely watched by key players.

Market Sentiment and Strategic Considerations

Despite bullish signals, analysts caution traders to remain vigilant. XRP’s mid-base channel currently acts as a key accumulation zone. As long as the asset holds above the channel, upside potential remains. Consecutive closes below this level, however, could indicate short-term weakness.

Crypto experts suggest a balanced approach to trading XRP. While moon targets such as $9 remain mathematically possible, these are based on extended projections and require careful risk management.

Final Thoughts

XRP is showing signs of strong accumulation within its mid-base channel, supported by whale activity and a dense liquidity cluster between $3.2–$3.8. Holding above this channel suggests that upside momentum toward $3.60 remains possible, with technical indicators pointing to potential further gains. Traders and investors are watching these levels closely, as they could determine the next significant move for the asset.

XRP was trading at around $2.66, down 0.70% in the last 24 hours at press time. Source: XRP price via Brave New Coin

However, caution remains essential. Consecutive closes below the channel or key resonance lines could signal weakness, while ambitious targets like $5–$10 require careful risk management. A strategic approach, laddering positions, and leaving small “moon bags” for long-term growth can help navigate the market’s volatility without overexposure.